401k distribution tax calculator

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year.

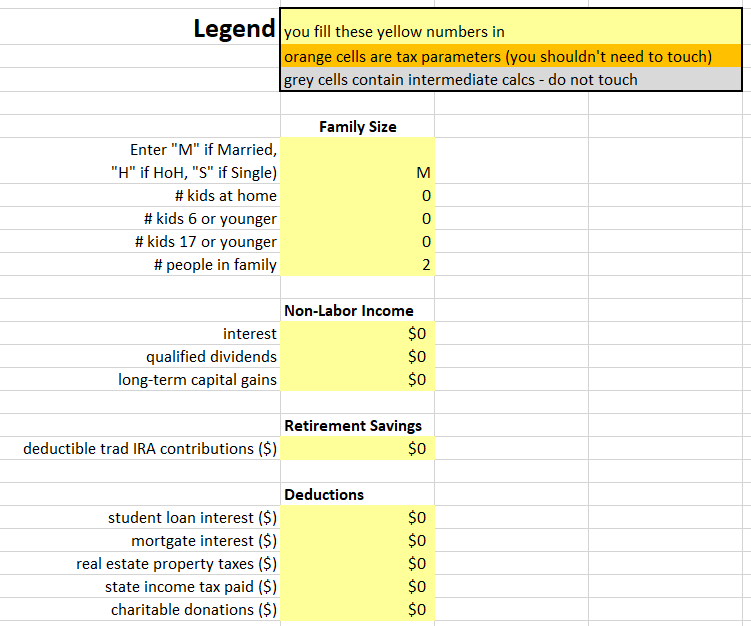

2021 Tax Calculator Frugal Professor

Traditional or Rollover Your 401k Today.

. 401k Early Withdrawal Calculator. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your.

This tax form shows how much you withdrew overall and the 20. Ad Make a Thoughtful Decision For Your Retirement. IRA minimum withdrawal calculator.

So if you withdraw the 10000 in your 401 k at age 40 you may get only. Please visit our 401K Calculator for more information about. Using this 401k early withdrawal calculator is easy.

1-800-KEY2YOU 539-2968 Clients using a TDDTTY device. 10 Best Companies to Rollover Your 401K into a Gold IRA. Ad Lower or Eliminate Your Taxes in Retirement.

Sign Up For a Free Retirement Roadmap Today. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20. Ad If you have a 500000 portfolio download your free copy of this guide now.

To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. When you take a distribution from your 401 k your retirement plan will send you a Form 1099-R. The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes.

If you are under 59 12 you may also. Dont Wait To Get Started. Clients using a relay service.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. What is the financial cost of taking a.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

As an example we will enter 100000 as the account. See How Much Money You Need To Retire Early. TIAA Can Help You Create A Retirement Plan For Your Future.

If I deposit a certain amount in my 401k each month what will it grow to by any future point in time. Even without matching the 401k can still make financial sense because of its tax benefits. Sign Up for a Free Retirement Webinar Online.

This guide may be especially helpful for those with over 500K portfolios. Required Minimum Distribution Calculator. If you dont have data ready.

Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important. Lets go back to the 401k calculator. That extra 6000 basically makes the calculation a no-brainer.

Sign Up For a Free Retirement Roadmap Today. Only distributions are taxed as ordinary income in retirement during which retirees most likely fall within a lower tax bracket. In this case your withdrawal is subject to the.

Sign Up for a Free Retirement Webinar Online. Ad Lower or Eliminate Your Taxes in Retirement. See How Much Money You Need To Retire Early.

Open an IRA Explore Roth vs. Retirement planner Retirement pension planner. 401 k distribution tax form.

In general contributions to retirement accounts can be made pre-tax as in. Protect Yourself From Inflation.

Tax Calculator Estimate Your Income Tax For 2022 Free

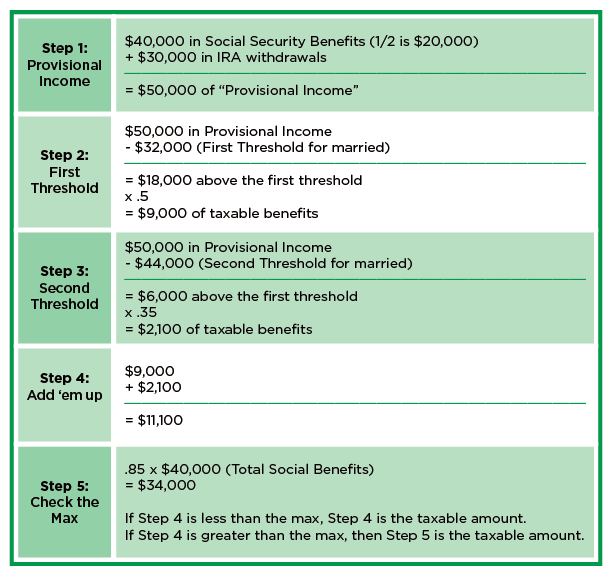

Taxable Social Security Calculator

Retirement Income Calculator Faq

Income Tax Calculator 2021 2022 Estimate Return Refund

Free 401k Calculator For Excel Calculate Your 401k Savings

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Calculate Your Earnings By 401k Withdrawal Calculator 401k Calculator Will Be Providing You The Result For How To Plan Saving For Retirement Guaranteed Income

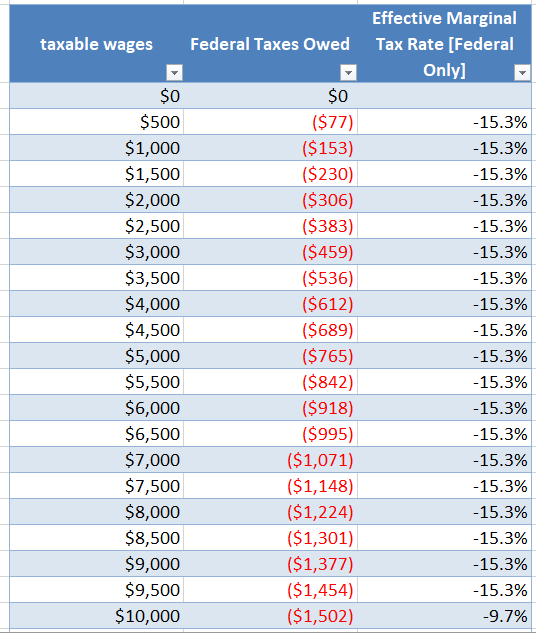

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

2021 Tax Calculator Frugal Professor

The Mega Roth An Interesting Twist For Super Savers Under The Proposed New Secure Act Tax Free Savings Retirement Money Savers

Roth Vs Traditional 401k Calculator Pensionmark

Safe Withdrawal Rate For Early Retirees 401k Withdrawal Retirement Calculator How To Plan

Pin On Personal Finance

Find The Federal And State Income Tax Forms You Need For 2019 Official Irs Tax Forms With Instructions Are Printable And Can Be Income Tax Irs Taxes Tax Forms

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Traditional Vs Roth Ira Calculator